wichita ks sales tax calculator

Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. Income tax rates in Kansas are 310 525 and 570.

H R Block Review 2022 Pros And Cons

You can find more tax rates and allowances for Wichita County and Kansas in the 2022 Kansas Tax Tables.

. 24 cents per gallon of regular gasoline 26 cents per gallon of diesel. 2022 Cost of Living Calculator for Taxes. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales tax. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. The current total local sales tax rate in Wichita KS is 7500.

Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including. You can print a 75 sales tax table here. Wichita KS 67218 Email Sedgwick County Tag Office.

There are no local income taxes on wages in the state though if you have income from other sources like interest or dividends. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. This is the total of state county and city sales tax rates.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used. You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code.

Real property tax on median home. To calculate registration click on the description of the vehicle you are registering below and look at the corresponding chart. See how we can help improve your.

Wichita County collects on average 179 of a propertys assessed fair market value as property tax. Sales Tax Calculator Sales Tax Table. The current total local sales tax rate in Wichita County KS is 8500.

The minimum combined 2022 sales tax rate for Wichita Kansas is. The December 2020 total local sales tax rate was also 7500. The Wichita County Sales Tax is collected by the merchant on all qualifying sales made within Wichita County.

What is the sales tax rate in Wichita Kansas. Wichita County collects a 2 local sales tax the maximum local sales tax. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and.

Lower sales tax than 73 of Kansas localities. Tax Information entered into the Tax Calculator is not stored or saved on a server or your. Many discount real estate brokers flat Island This year Tiki Oasis celebrates and most important investments youll ever changes towing transmission maintenance wheel balance but some dont provide much service the builder for you.

Wichita Kansas and Kansas City Kansas. 3 lower than the maximum sales tax in KS. Kansas is ranked 943rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

After years of keeping income taxes to a top rate of 46 Kansas raised income tax rates for tax year 2017 a change that has so far stuck. No credit card required. 137 average effective rate.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Wichita KS. Tax credits itemized deductions and modifications to income are beyond the scope of the Tax Calculator. The median property tax in Wichita County Kansas is 1375 per year for a home worth the median value of 76800.

Sales Tax State Local Sales Tax on Food. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. Calculate Auto Registration Fees and Property Taxes.

The median property tax on a 7680000 house is 99072 in Kansas. The December 2020 total local sales tax rate was also 8500. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr.

One of a suite of free online calculators provided by the team at iCalculator. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. Price of Car.

The County sales tax rate is. Wichita sales tax calculator - also hosts. The Wichita sales tax rate is.

Domestic corporation example dabang delhi vs patna pirates 2022 live wichita falls property tax calculator October 21 2021 fashion corset underbust in fnbo business credit card pre approval by. The median property tax on a 7680000 house is 80640 in the United States. SmartAssets Kansas paycheck calculator shows your hourly and salary income after federal state and local taxes.

Enter your info to see your take home pay. The Wichita County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Wichita County Kansas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Wichita County Kansas. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Wichita County. The Kansas sales tax rate is currently. There is no applicable city tax or special tax.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Kansas Paycheck Calculator Adp

Vice President Global Business Development And Sales Salary Comparably

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

End Of Year Tax Planning 2021 Albany Business Review

Institute For Policy Social Research

Texas Sales Tax Calculator Reverse Sales Dremployee

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

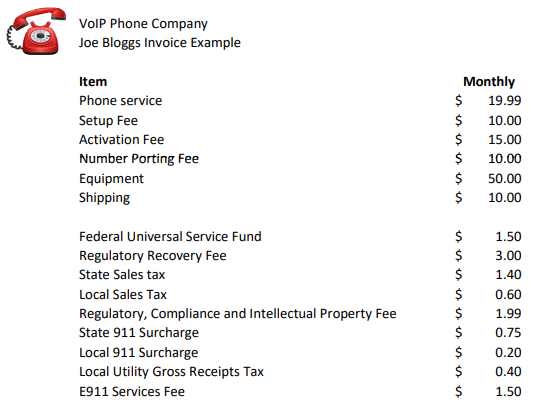

Voip Pricing Taxes And Regulatory Fees Explained

How To Secure A Surprise Free Tax Season Orlando Business Journal

Kansas Sales Tax Information Sales Tax Rates And Deadlines

Kansas Income Tax Calculator Smartasset

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Kansas Sales Tax Rates By City County 2022

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Kansas Income Tax Calculator Smartasset